You know the drill. Spend less than you earn, stick to a budget, and “watch the pennies turn into pounds” as grandma used to say. What gran never mentioned is that growing savings isn’t always easy. Life is expensive, and there always seems to be a bill waiting to be paid.

If you’re struggling to build savings, you’re not alone. Canstar’s latest Consumer Pulse1 report shows one-in-five Aussies are having a tough time saving money – and that’s because they’re living payday to payday.

But there is a way to break the cycle, and turn the tide in your favour so that saving becomes a simple habit. And the best tool for the job can be a bucket.

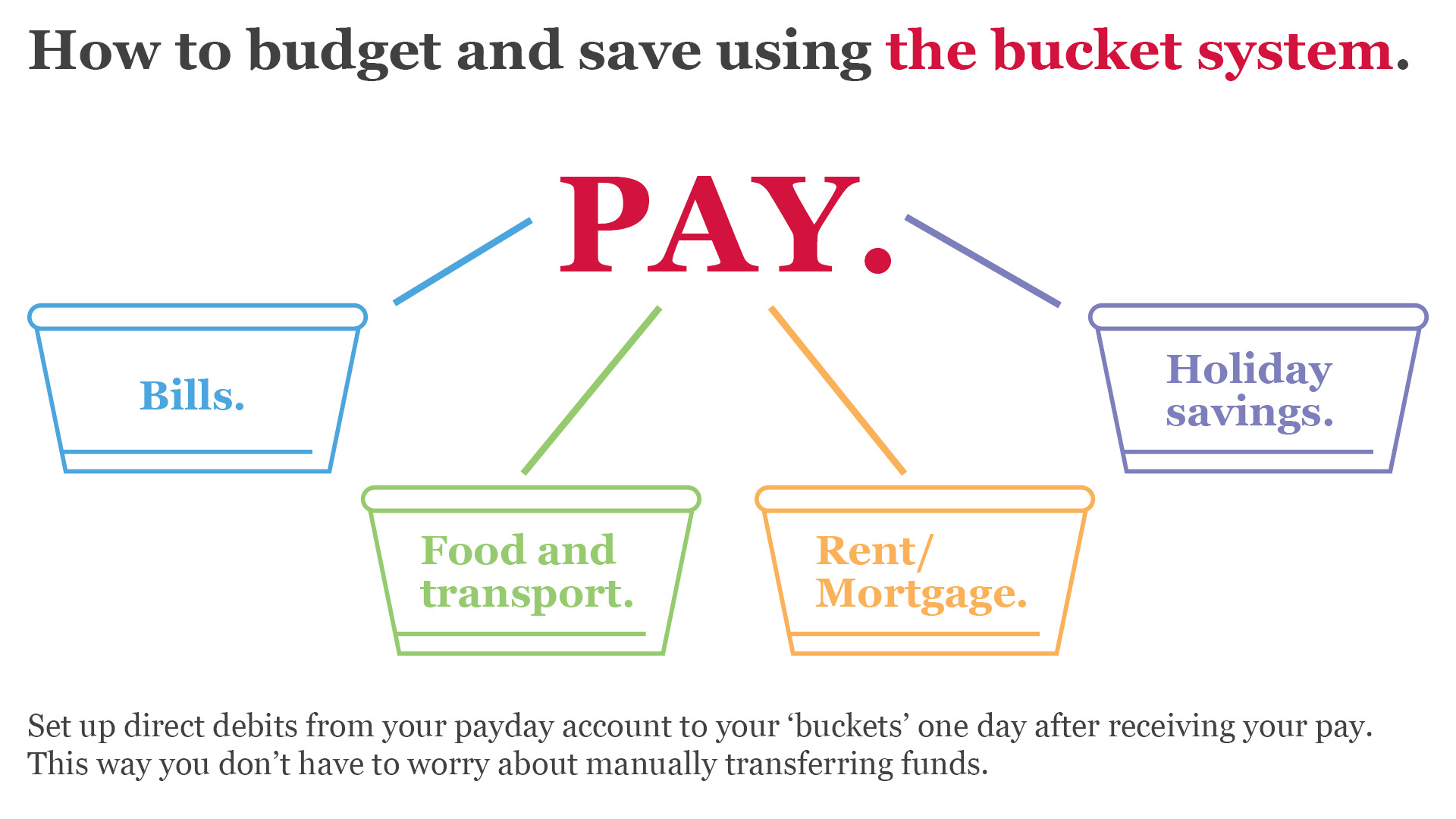

We’re not talking buckets with plastic handles that live in the laundry. It’s more about savings buckets – separate places to stash your cash for different purposes. Here’s how it works.

Divide your pay across different needs.

Back in the day when people were paid in cash, it was a common habit to divide a week’s wages across various expenses, then store the money allocated to each bill in separate envelopes – one envelope for groceries, one for rent, another for paying bills like electricity, and so on.

Having all that cash stored in the house must’ve been a burglar’s delight. But the concept of dividing your pay packet across different needs still holds merit today.

These days, we’ve switched from paper envelopes to digital buckets. So all you have to do is work out how much you need to set aside each month for various household bills. Then, set up different transaction accounts for specific expenses – maybe one for home loan repayments, another for bills, and one for fun spending. You get the idea. The money remaining once bills are accounted for goes straight to a separate savings account.

An everyday account to ace your buckets.

The great part about the ‘bucket’ approach is that Defence Bank’s Everyday Access account comes with no monthly account keeping fees. So it’s not going to cost you to have more than one account. And you can pick your choice of camo-coloured Visa Debit card – maybe one for bills, and one for personal spending, so you know which account you’re dipping into when you’re on the go.

Spreading your pay packet across different buckets is easy. Just set up a regular electronic transfer of funds from one account to another, time it to match with payday, and it all becomes effortless.

Even better, Defence Bank’s Everyday Access account comes with optional save-as-you-spend Round Ups. It’s like putting savings on auto-pilot.

Bucket your savings.

When it comes to a savings account with a competitive interest rate, Australia’s Defence Bank has you covered. And our range of savings accounts means you can extend the bucket system to your savings.

Use one savings account to grow funds for, say, a vacation or new car, another to buy a first home, and maybe a separate account to stash emergency money so you have a buffer of cash when unexpected bills crop up.

Dividing your regular pay this way makes it a lot easier to stick to a budget, and it comes with the satisfaction of knowing you’ve mastered your money – and built savings to boot. Why not give it a shot, and see how the simple bucket could transform your money management?

To get started with your bucket system, you can count on the team at Australia’s Defence Bank to get you started. Call our Contact Centre on 1800 033 139, or visit your local branch to find out more.

1 https://www.canstar.com.au/consumerpulse/

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.