You care about your property and valuables, so make sure they’re protected and get peace of mind that they’re being covered.

Losing your home or business to a fire is life changing. This coming bushfire season prepare for the worst and make sure the valuables you’ve worked so hard for are appropriately protected before it’s too late.

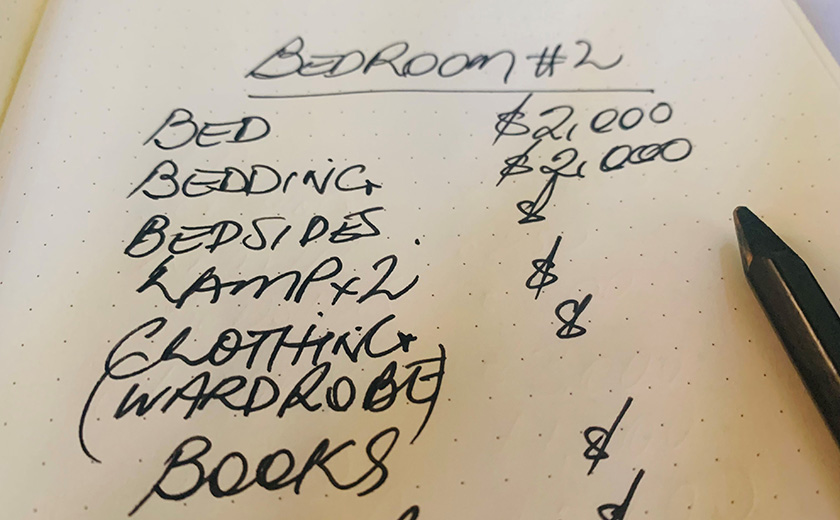

After a bushfire, it’s overwhelming to record what has been lost but you can ease the burden by thoroughly preparing and planning. If you live or work in a high-risk bushfire area and would like the peace of mind that comes with being covered, appropriately manage the possible fire threats to decrease the risk of damage to your property, assets and livelihood by following the checklist below.

Bushfire preparedness checklist.

- Check the bushfire risk in your area. Remember, you don’t have to live right near the bush to be at risk. Even if your home is a few streets away from bushland, you are still vulnerable.

- Make a Bushfire Survival Plan (check with your local fire service authority).

- Check that you have home buildings and contents insurance and that your policy is up to date.

- Check that you have appropriate insurances in place for any vehicles, boats or caravans that may be on your property. They may not be covered in your home buildings and contents policy.

- Use an online insurance calculator as a guide to help you decide how much to insure your house for.

- Regularly check your Bushfire Attack Level (BAL) and the relevant rebuilding requirements with your local fire authority or local government body as these ratings can change without notice.

- If you’re a small business, check if you are covered for the costs of interruption to your business if there is a bushfire.

- For more bushfire specific information see the below fact sheets.

Insurance checklist.

In the event of a bushfire, it’s important to ensure you have adequate insurance cover. Here’s what you should look out for:

- Check whether you’re adequately covered for ‘removal of debris’ which cover the clean-up costs after a fire.

- Check that your insurance policy covers you for the cost of temporary accommodation in case your home is uninhabitable due to a bushfire.

- Make sure the final amount you decide to cover your home for includes clean-up and rebuild costs.

It’s important to ensure you have adequate cover, so you have the right support when you need it most.

Use a Home & Contents Calculator to estimate your replacement cost needs.

This page provides general advice only. For up-to-date and specific advice relating to the risks in your area please speak to your local council or emergency services.

Home Insurance issued by Insurance Australia Limited ABN 11 000 016 722 AFSL 227681 under the CGU brand. The advice on this page is general advice only and does not take into account your individual objectives, financial situation or needs (“your personal circumstances”). Before using this advice to decide whether to purchase the insurance policy, you should consider your personal circumstances and the relevant Product Disclosure Statement available from cgu.com.au.