Having ‘up to 55 days interest-free’ is great, just be sure to make it work for you.

The most common misconception about ‘up to 55 days interest-free’ is that the 55 days start from the date of purchase. You might assume once 55 days have passed, interest will then be accrued on any outstanding amounts.

Makes sense, right?

Yes, but no.

For nearly all purchases, the ‘55 days interest-free’ refers to the maximum number of interest-free days available from when your statement period starts.

Q: When does my statement period start?

A: At Defence Bank, the start of your statement period is the first day of the calendar month.

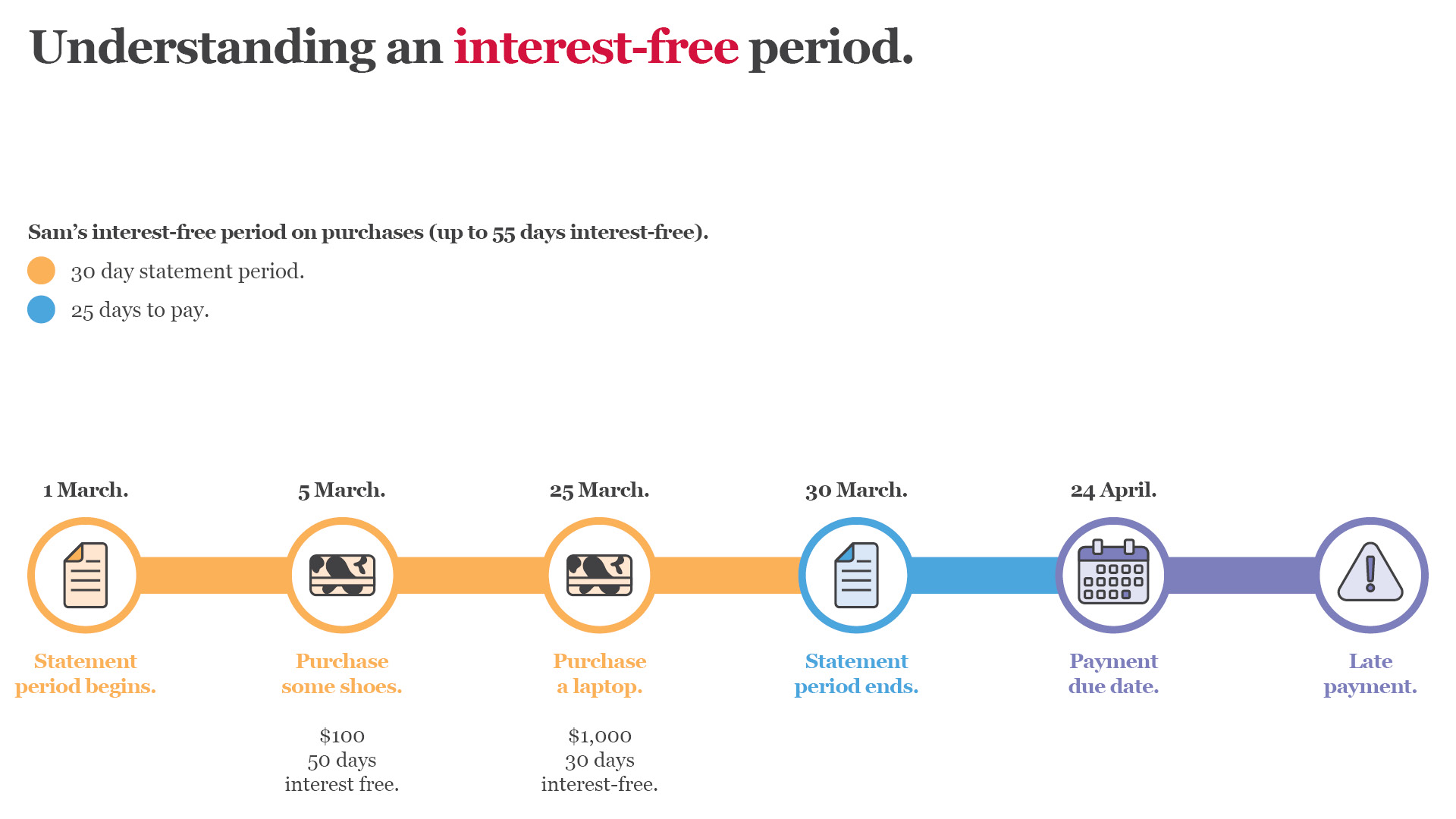

To receive the full 55 days interest-free days you need to make your purchase on the first day of your statement period. As you continue to make purchases throughout the statement period the number of interest-free days decreases.

TIP: If you are planning to buy a big-ticket item make this purchase at the beginning of your statement period so you have more interest-free days to pay it off.

A good example is usually a good idea.

Sam’s statement period starts on 1 March. On this day he purchased a pair of shoes for $100. Sam has the full 55 days interest-free to repay the $100 by 24 April. Sam then bought a laptop for $1000 on 25 March. As he purchased the laptop within the same statement period, Sam now only has 30 interest-free days to make repayment by 24 April. If there are any outstanding balances remaining on the card as at 25 April, interest will begin to accrue on this amount.

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.