Having an investment property can be tricky business if you don’t have landlord insurance to back you up. Without it, you potentially expose yourself and your investment to unnecessary risks that could be taken care of with the right protection.

There are usually a few to choose from, like Landlord building and contents, Landlord building as a stand-alone product, or Landlord contents as a stand-alone product. Whichever you choose, your landlord insurance can cover against risks such as fire, storms and other natural disasters. It will usually include cover for the fixtures such as light fittings, carpets, ovens, stovetops and window coverings.

With the right landlord insurance, you can also protect yourself from financial loss caused by damage to your rental property by your tenants or their guests.

A landlord’s policy will often include both accidental damage and malicious damage caused by tenants. It can cover the loss of rent that you might experience because damage has left your property unable to be leased.

Not sure which landlord insurance will suit your needs? You can never predict the unexpected, so it’s a good idea to opt for both building and contents landlord insurance as it covers a lot more than if you were to choose one over the other.

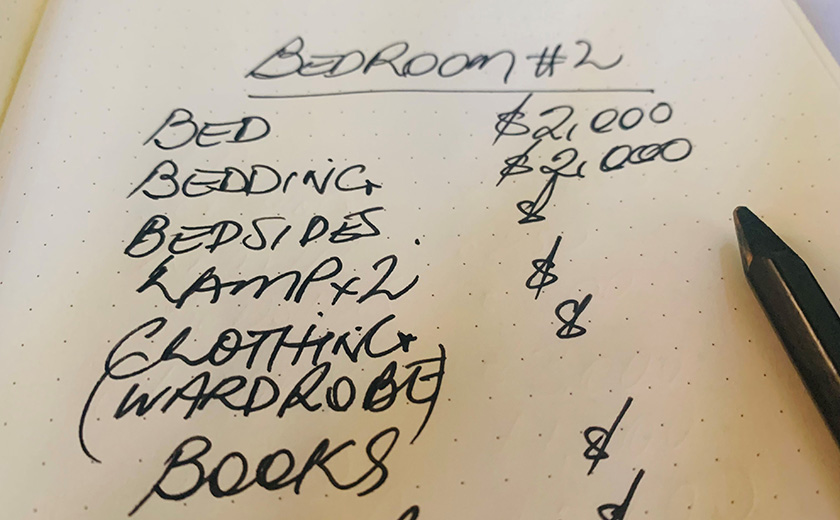

In a snapshot, many Landlord building and contents insurance will cover things like:

- Water damage

- Essential repairs

- Fire, flood and storm damage

- Theft

- Damage to internal fittings such as curtains, carpets and appliances

- Malicious damage by tenants or their guests

- Legal liability for tenants and their guests

- External structures in the home, for example the roof, grounds etc. from storm, fire or flood damage

- Loss of rent outside of extenuating circumstances, for example normal end of lease or failure to find new tenants.

Learn more about landlord insurance.

Insurance issued by Insurance Australia Limited ABN 11 000 016 722 under the CGU brand. Any advice in this article is general only and has been prepared without taking into account your personal objectives, financial situation or needs. Consider the relevant PDS available from cgu.com.au to see if a product is right for you.