Never needed to make a claim? You’re one of the lucky ones. If you’re not familiar with how to make a claim, this guide will help demystify the process.

Are you covered for that?

First, contact your insurer with details of the claim, and they’ll take a closer look at the details to check if what you’re claiming is covered by the policy. If yes, the claim will then proceed to the next step where the insurer will provide you with the value of the claim.

What does your insurer need?

There’s quite specific information that your insurer needs from you to proceed. Some of these include:

• Verification of your personal and policy details.

• The name of the policyholder.

• A detailed description of the incident.

• The date of the incident or event.

• The address where it happened.

• Details of any other parties involved.

Sometimes the success of the outcome will depend on the type of claim you’re making and how much information you’re able to provide. This may include:

• Medical certificates or hospital discharge paperwork.

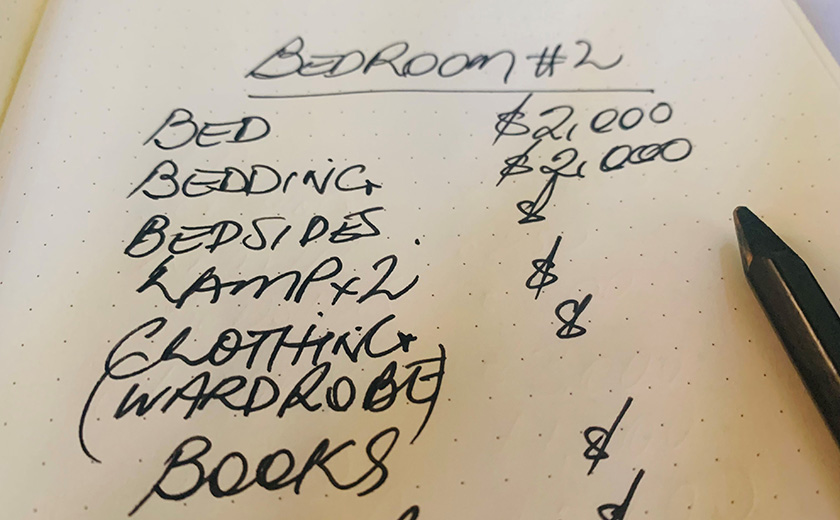

• Proof of ownership including receipts, packaging or photographs.

• Police reports and statements.

• Damage reports from repairers.

• Quotes or estimates.

Keep your insurance information handy.

Although your insurer will have all your policies stored electronically, it still makes it easier if you have your insurance paperwork in an easy to find place. This means you can double check your paperwork ahead of starting a claim and read your Product Disclosure Statement (PDS). Any other questions about making a claim? Check out the CGU CLAIMS FAQs here.

If you need to make an insurance claim call 13 24 80.

Find out more about our insurance products.

Insurance issued by Insurance Australia Limited ABN 11 000 016 722 under the CGU brand. Any advice is general only. Consider the relevant PDS available from cgu.com.au to see if a product is right for you.

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.