Whether you plan on visiting family in the country, attending a wedding interstate, or just a quick trip out of town, when it comes to domestic travel within Australia, travel insurance is always worth considering.

Why domestic travel insurance is a good idea.

Almost everyone who travels overseas will purchase travel insurance. When travelling to unfamiliar places and countries, having travel insurance can give you a sense of security should something go wrong. Unlike international voyages, travel insurance for domestic holidays is often overlooked. But if you explore further, you’ll discover that there’s not much of a difference between the two.

Here’s why you might want to consider travel cover for your next domestic trip.

Baggage and other belongings.

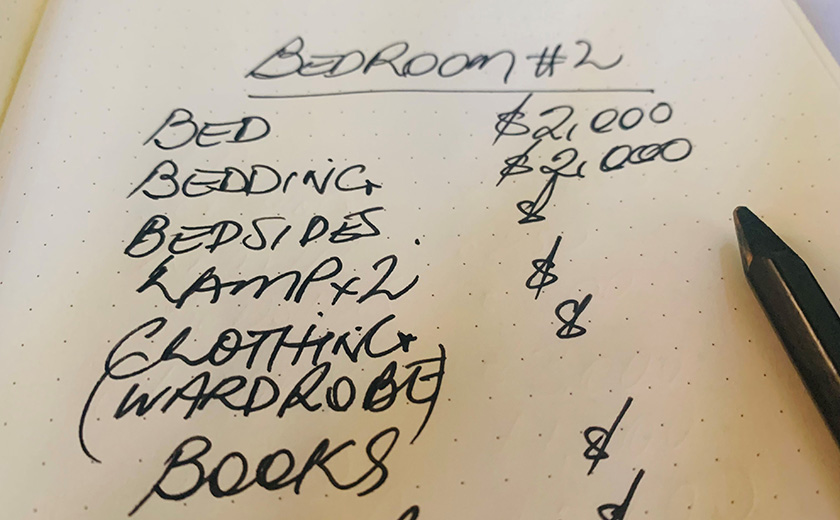

Sometimes your baggage can be mishandled and damaged, get lost, stolen or even miss your flight, leaving you without belongings for a few days or for the entire stay away. Whatever the reason is, being without the things you packed can be extremely inconvenient. Domestic travel insurance can cover the loss of your belongings for an agreed amount if you do not have proof of purchase readily available.

Flight cancellations.

Next time you book an interstate flight, you might rethink booking the cheaper seat. It usually lacks flexibility and may not cover you for unexpected delays. Last-minute changes to flights can be expensive and may affect event bookings and accommodation, leaving you more out of pocket. But it’s good to know that your travel insurance can help cover some of these expenses if you need to cancel or change your plans.

Rental cars.

Thinking about hiring a car? It’s generally the best way to get around and see the sights. While some rental companies offer cover, it’s always a good idea to make sure you have your own cover in place before you drive away. Paying for the excess on your insurance policy is no comparison to paying for the repair or replacement of a damaged or stolen vehicle.

Additional activities.

If you’re planning on skiing, golfing, or any other physical activity, you may be required to take out additional optional travel insurance. This can cover you for the items taken away with you, items you hire that get lost or stolen, or even physical injury while you’re on your trip. Remember, to mention to your insurer if you plan on doing additional activities as they may not be included in your standard policy.

What domestic travel insurance may not cover.

Many domestic insurance policies generally won’t cover medical expenses incurred within Australia. However, according to Canstar, Australian citizens and permanent residents can use their Medicare card or private health insurance to help cover some, or all, of the medical costs involved.

They go on to say, “as with most insurance policies, there are some general exclusions to be aware of. Some you may find in a domestic travel insurance policy include breaking the law, being under the influence of alcohol or illicit drugs, not disclosing a pre-existing condition, not taking reasonable steps to protect your belongings, or ignoring official warnings or advice.”

It's important to remember that not all domestic travel insurance policies are the same. The level of cover, exclusions, and excesses will vary between policies, and companies. Most importantly, always read the terms and conditions and the Product Disclosure Statement (PDS) of each policy before deciding what is right for you.

Thinking of travelling around Australia? The team at Defence Bank can help with your domestic insurance. Call our Contact Centre on 1800 033 139 or visit your local branch to find out more.

Find out more about Defence Bank travel insurance.

Insurance issued by Insurance Australia Limited ABN 11 000 016 722 trading as CGU Insurance. Any advice in this article is general only and has been prepared without taking into account your personal objectives, financial situation or needs. Consider the relevant PDS available from cgu.com.au to see if a product is right for you.

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.