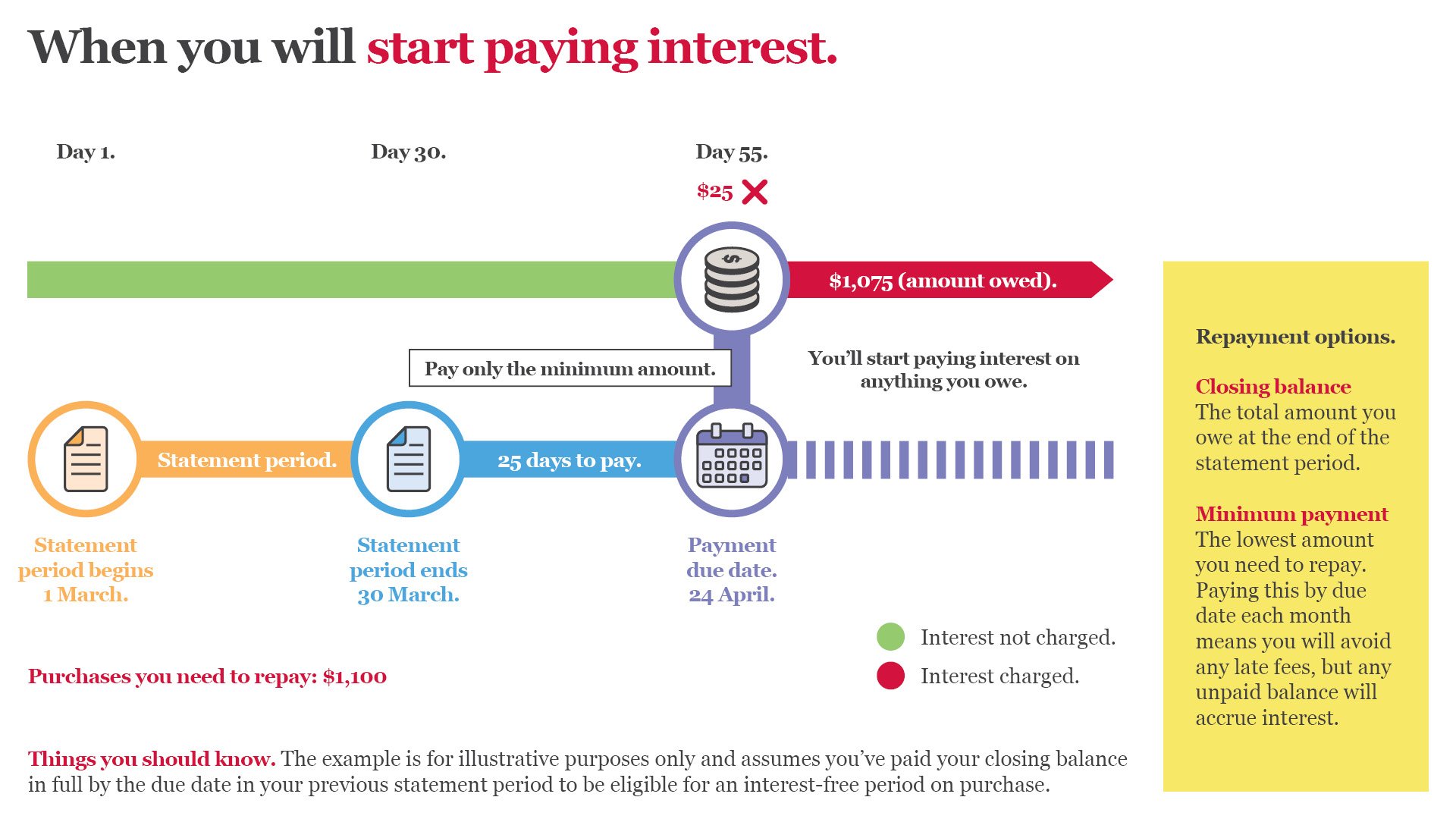

The minimum monthly repayment on a credit card is the lowest amount you are required to pay to meet your credit contract. On your Defence Bank Foundation Visa Credit Card your minimum repayment is $10.00 or 3.00% of the closing balance of each statement - whichever is the greater.

Making the minimum monthly repayment on time is the must-do to avoid late fees and maintain a good repayment history so your credit report is not affected (read more credit card payments and your credit score).

While it can be tempting to make the minimum repayment each month, especially if your budget is tight, you need to keep in mind that the less you pay now, the more you’ll pay later, and the longer it will take to pay off your credit card balance. So where possible, pay more than the minimum amount to stay on top of your credit card balance.

By the way, even if you make the minimum payment by the due date of your statement, you will still pay interest on the remaining balance.

What is the minimum repayment warning on my credit card statement?

On your Defence Bank credit card statement two different scenarios are provided based on your closing balance, and these can be very different from each other.

The first scenario provides an estimate of how long it would take to pay off the balance should you choose to pay the minimum amount each month (and make no more purchases and fees and the interest rate remains the same).

The second scenario gives an estimate of how much you would need to pay each statement period to pay off the closing balance in 2 years – again assuming you make no additional purchases and fees and the interest rate remains the same.

Here is an example from a sample statement with a closing balance of $1074.18, which assumes an interest rate of 8.99%, no late payment fee, no overdue amounts and a minimum repayment amount of $32.23 for the statement period.

The warning below is an Australian Government Requirement and the information provided is a guide only. Minimum Repayment Warning: If you make only the minimum payment each month, you will pay more interest and it will take you longer to pay off your balance. For example:

| If you make no additional charges using this card and each month you pay… | You will pay off the Closing Balance shown on this statement in about… | And you will end up paying an estimated total of interest charges of… |

| Scenario 1. Only the minimum payment. | 39 months | $163.32 |

| Scenario 2. $48.94 | 2 years | $100.34, a saving of $62.98 |

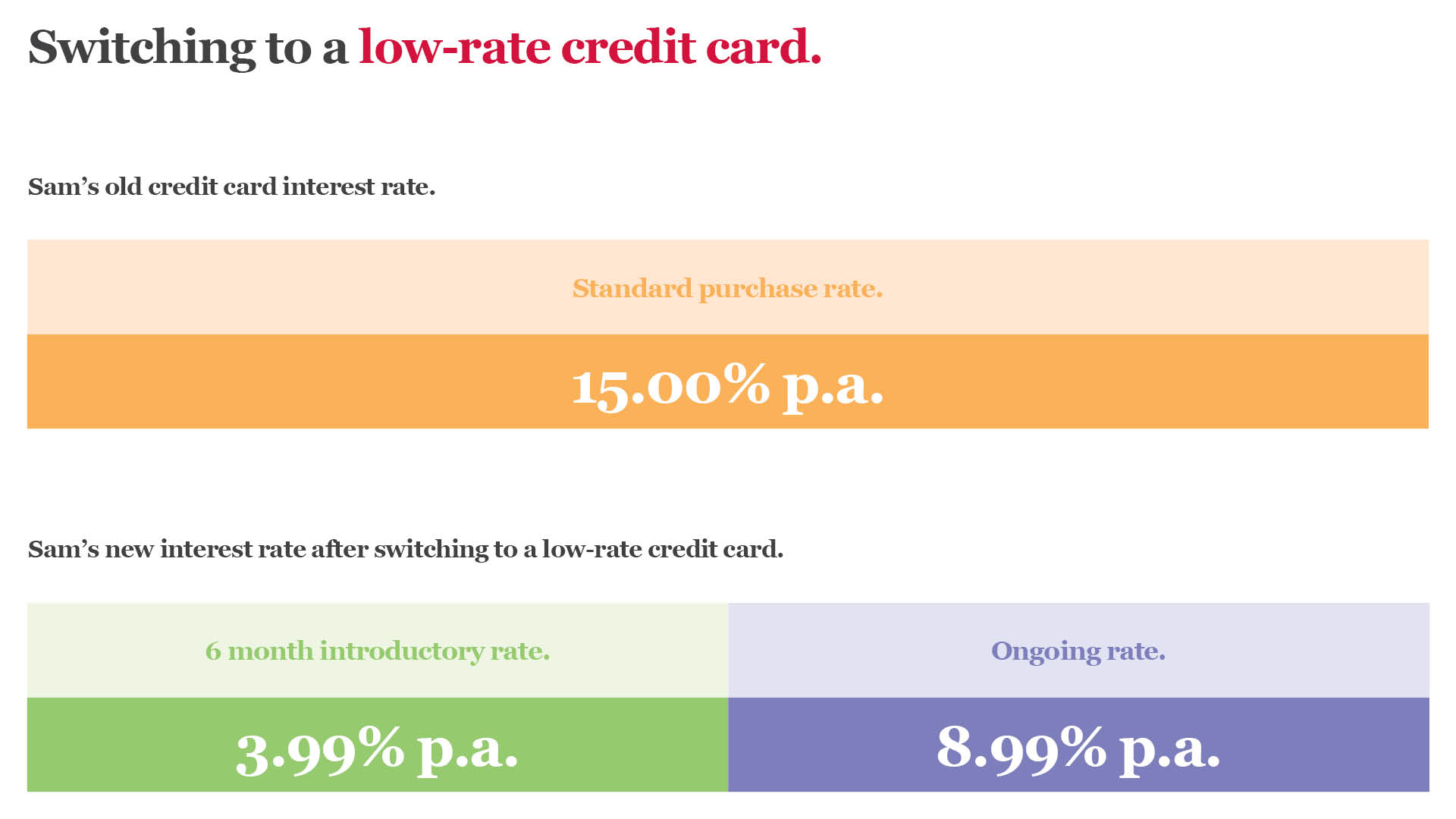

Why switch to a low-rate credit card.

One way to pay off your outstanding credit card balance is to review the interest rate you’re paying and switch to a credit card that offers a lower interest rate. When you switch to the low-interest rate Defence Bank Foundation Visa Credit Card, a special introductory rate may be available which will save you even more money as you get back on top of your finances.

Read next…

Know what ‘up to 55 days interest-free’ means and how to use it to save you money.

Important note: This information is of a general nature and is not intended to be relied on by you as advice in any particular matter. You should contact us at Defence Bank to discuss how this information may apply to your circumstances.